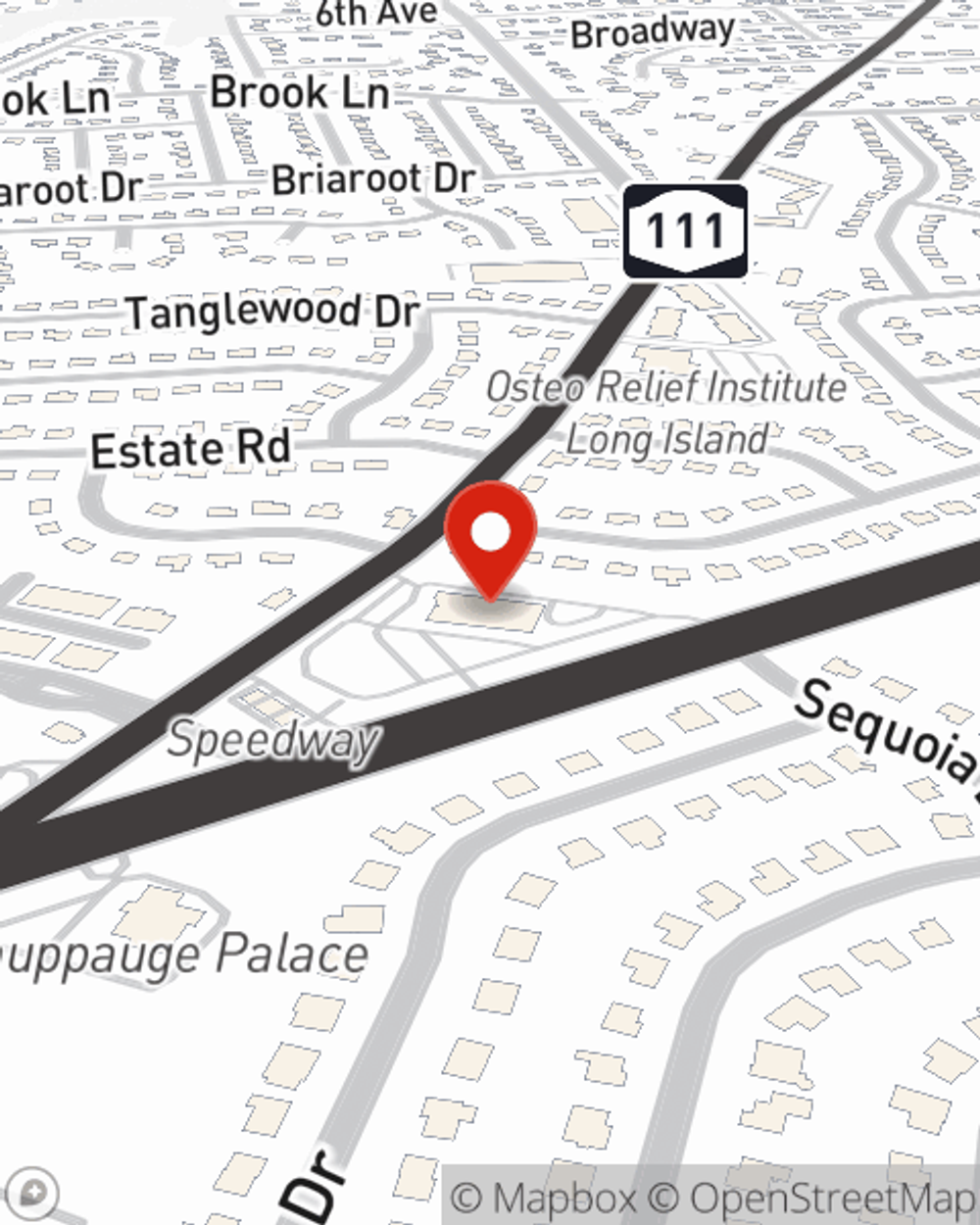

Business Insurance in and around Smithtown

One of Smithtown’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Cost Effective Insurance For Your Business.

Preparation is key for when the unexpected happens on your business's property like an employee getting injured.

One of Smithtown’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

Protecting your business from these possible accidents is as easy as choosing State Farm. With this small business insurance, agent Jennifer O'Brien can not only help you design a policy that will fit your needs, but can also help you submit a claim should a mishap like this arise.

Take the next step of preparation and call or email State Farm agent Jennifer O'Brien's team. They're happy to help you research the options that may be right for you and your small business!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Jennifer O'Brien

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.